However, some renters insurance companies will. Pet insurance is designed to offer financial protection for vet bills, while renters insurance covers your pet’s incidentals to other visitors on your property.

Cape San Blas Lighthouse Beach cottage rentals, Cottage

Look at your current policy and ensure it is accurately representative of your risks, including whether or not you have a pet.

Is pet damage covered by renters insurance. Damage to your own property: It’s my first time buying renters insurance, where do i start? Its essential policy does not offer this cover.

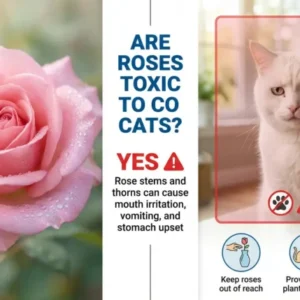

Suggested read: Are Roses Toxic to Cats? What Pet Owners in the U.S. Need to Know Right Now

Renters insurance only offers personal property damage coverage for “covered perils,” like fire or theft. For example, if your cat decides to use your sofa as a scratching post, you'll have to repair or replace it yourself. Renters insurance will not cover damage inflicted by your pet to your own property.

See some scenarios where you might need renters insurance here. It depends on the state, type of pet and the insurance company. Pet health insurance normally costs between $10 to $100 per month, with most pet owners paying $30 to $50.

Renters insurance doesn’t cover any pet damage to property, including yours or your landlord’s. We contacted the home insurers listed in our guide to the best home insurers in may 2018, to ask if they covered damage in the home caused by domestic pets. Pet insurance vs renters insurance coverage.

Albany, ny renters insurance doesn’t cover pet damage, but it can cover injuries caused by a pet, for example. Renters insurance also doesn’t cover any health issues that occur with your pet. Pet damage to rented accommodation is unlikely to be covered by your insurer, so if you plan on renting with pets, make sure you discuss this possibility with your landlord.

Suggested read: What's Behind the Rising Interest in Bengal Cat Price Across the US?

If you have a pet, renters insurance is a straightforward way to cover your legal risk in case your pet ever causes injuries or property damage to other people. That’s because the personal property coverage included in your renters insurance policy only covers certain types of damage, known as perils, and pet damage isn’t considered a covered peril. Is animal damage covered under my pet insurance?

As mentioned, renters insurance covers pet damage to other people’s property. Renters insurance doesn't cover pet damage to your personal belongings. What you still have to pay if damage occurs, even with insurance) of $500 to $1000.

Pet damages that aren't covered by your renters insurance policy. However, some renters insurance policies may specifically exclude certain breeds of dogs. What’s covered under accident and illness pet insurance:

If your new puppy pees on some of your electronics or chews up your furniture, it won’t be covered by your renters. While the personal property coverage in a homeowners insurance policy may help protect your belongings against certain risks, there is generally no coverage for. Whether you have a dog, cat or any other type of pet living in your home, it’s also a good idea to ensure that they are regularly stimulated so they don't get bored.

Suggested read: Tips for Bathing Your Cat: A Comprehensive Guide

At this price, most renters are covered for $30,000 to $50,000 worth of damage, with a small deductible (i.e. With or without a pet, if you are a tenant, we strongly recommend you shop for an individual renters insurance policy , as the liability coverage will extend to a variety of incidents for which you could be found liable. While renters insurance may cover liability if your pet damages someone’s property or injures them, that is not the same for every renter’s insurance cover.

Pet damage coverage, which may be called animal liability, can be a very valuable type of coverage to have. Home insurers that cover pet damage. Depending on the company they will not insured you or cancel the policy the minute you do not disclose the pet.

Additionally, you might need a separate pet insurance policy to cover routine or irregular vet bills when they arise. However, it does cover pet damage to people in the form of dog bites, which are one of the most costly renters insurance claims filed. Saga does cover damage caused by chewing, scratching, tearing or fouling under its premier policy.

While homeowners insurance may help protect your home and its contents from certain risks, it typically provides limited coverage for pet damage. If you negligently allow your pet to damage your apartment, that could be covered under liability as well, as long as you took steps to mitigate it as soon as you knew or should have known. However, renters insurance doesn’t cover pet damage to your own property.

Pet insurance covers vets’ bills and the cost of medical treatment for your family pet. Some landlords refuse to accommodate tenants with animals for this reason, while others may require you to cover the cost of damage to their property if you’re renting with a dog or cat. If you have a dog, your coverage will likely.

Suggested read: Sunrise Pet Clinic Vets

However, neither renters nor pet policies cover pet damage to the rental itself, leaving you to shoulder that risk on your own. If you have homeowners or renters insurance owning a pet could be difficult. Does your renters insurance cover pet injury or damage liability?

It’s a common requirement, and you should make sure you disclose exactly what kind of pet you have when you buy the insurance policy, because renters insurance cancellation for material misrepresentation is a clear and present danger if you do otherwise. If you have renters insurance, pet bites are covered under your policy's personal liability coverage. Pest infestations, natural disaster damage and property damage from your pet are not covered.

Does renters insurance cover pet damage? So the short answer to are pets covered under renters insurance is “not as personal property, not for injury or illness, but potentially for liability.” Pet damage to your own or other persons property generally wont be covered by insurance companies.

It does not cover damage they cause to your property. Renters insurance usually doesn’t cover pet damage. Damages caused by your pets are not considered a covered peril.

Suggested read: Mickey Mouse Clubhouse Pete's Beach Blanket Luau Youtube

“liability insurance also can protect you from liability if a person is accidentally injured in your home or if you or a family member accidentally injure.

Help for Homeschool Families Impacted by Hurricane Harvey

Heavy vehicles can cause more damage if they are involved

Suggested read: How Much Is Urgent Care For Dogs

Luxury Home Like Gulf Front, Private Heated Pool, Elevator

Home Car insurance, Insurance broker, Car

All Weather Cover for Little Guy Trailers Little guy

Insurtech startup Kin secures 47 million to focus on

Suggested read: Patio Pet Doors For Sliding Doors

Wedding Insurance Are you covered? Pet insurance cost

First Community Insurance Services facilitates Fort Hood

Rental car insurance, health, life, travel, flood, renters

Top 10 Insurance Affiliate Programs To Your

Suggested read: National Dress Up Your Pet Day Meme

40 Hold Harmless Letter Template in 2020 (With images

Awesome Security Deposit Receipt Template Of 2020 in 2020

First Community Insurance Services facilitates Fort Hood

Luxury Home Like Gulf Front, Private Heated Pool, Elevator

Suggested read: What Is The Best Carpet Cleaner Solution For Pet Urine

Heavy vehicles can cause more damage if they are involved